Browse our frequently asked questions to find the solutions you need.

A maximum of 50 shareholders are allowed on a license.

A maximum of 4 directors are allowed on a license.

Yes, you can acquire a 0-visa license at Meydan Free Zone. This includes a Lease Agreement, LLC-FZ Trade License that includes three Groups of business activities.

We suggest a capital of 100,000 AED. Please note we can’t specify the share capital for the client.

You can choose three Groups of business activities.

You are eligible for an Investor/Partner visa if you have invested AED 50,000 share capital or more in a company. If you are not a sole shareholder in the company, then you must apply for a Partner visa. However, you should apply for an Investor visa if you are the sole shareholder.

The maximum validity for the Meydan Free Zone license is up to 10 years.

A company can have only one manager on the license but can appoint various other field managers, e.g., Sales manager, Marketing manager, etc.

Yes, You can apply for a visa after the incorporation of my company, provided you have the immigration card and visa allocation.

Cabinet Resolution No. (53) of 2021 Concerning the Administrative Penalties against Violators of The Provisions of the Cabinet Resolution No. (58) of 2020 Concerning the Regulation of Beneficial Owner Procedures.

Yes, all Licensees are required to create and maintain a record of the UBO, Partners or Shareholders as per Cabinet Resolution No. (53) of 2021 Concerning the Administrative Penalties against Violators of The Provisions of the Cabinet Resolution No. (58) of 2020 Concerning the Regulation of Beneficial Owner Procedures..

The Register of UBO includes data in respect of the UBO and must be created and maintained, either as a hard or soft copy.

The Register of UBO is to be created within (60) sixty days from the date of promulgation or the date the Legal Person comes into existence. The Legal Person shall update and record any changes to the data contained in the Register of Beneficial Owner within (15) fifteen days of becoming aware of such change.

The Register of Partner or Shareholders includes data in respect of each Partner or Shareholder and must be created and maintained, either as a hard or soft copy.

As per Cabinet Resolution (53) of 2021 Administrative Penalties for Violators of the Provisions of the Cabinet Resolution (58) of 2020 Regulating Beneficial Owner Procedures, the penalties can depend on the clause breached and include a penalty fine and license suspension.

If the UBO is working for another company, the Licensee can include the company name and address, if not, the Licensee can include the name and address for the company registered in Meydan Free Zone.

Yes, Licensees can find a Registry Template on the Meydan Free Zone website under the Compliance – UBO section.

The goAML system was developed by the United Nations Office on Drugs and Crime (UNODC) to combat money laundering and the financing of terrorism. It is considered an integrated system used by the Financial Intelligence Unit (FIU) to receive, analyse and distribute suspicious transaction reports (STRs) in a fast and efficient manner. A large number of financial intelligence units worldwide are currently using it, and the United Arab Emirates is the first Gulf country to apply this modern system.

Licensees can register using the following link:

All Designated Non-Financial Businesses and Professions (DNFBPs) must register on the goAML portal. Please read your Trade/Commercial license and complete the DNFBP questionnaire on the MOE website to help determine if you are a DNFBP or not.

To open the goAML portal, you need to pass through the SACM portal by putting the username that you will obtain from the registration stage of the SACM protection system and the password from the Google Authenticator application.

SACM can be accessed at the following link:

https://eservices.centralbank.ae/sacm

Download the “Google Authenticator” application on your phone. (This application contains the password for the SACM protection system, which is a password that changes every minute)

The UAE Financial Intelligence Unit (FIU) analyses suspicious transactions and activities that may involve money laundering, terrorism financing and related criminal activities, based on data and reports from financial institutions (FIs) and designated non-financial business and professions (DNFBPs) that collaborate and share knowledge to detect and act against such activities.

For all IT and technical issues, send an email to

goAML@uaefiu.gov.ae

The Regulations apply to Licensees that carry out any of the following Relevant Activities.

The ESR Portal can be accessed through the MoF Economic Substance Webpage. To access the Portal, the entity must have an existing MOF corporate account, and use its credentials. If the entity is not registered as a corporate user, it can create an account through the MOF registration page.

Licensees and Exempted Licensees that undertake a Relevant Activity (irrespective of whether the Licensee or exempt Licensee has earned income from the Relevant Activity during the financial period) are required to file a Notification within six months from the end of the relevant financial period. All Notifications must be submitted on the Ministry of Finance filing portal.

No. Whilst the commercial license may indeed state the Relevant Activity, a ‘substance over form’ approach must be used to determine whether a Licensee undertakes a Relevant Activity and is within the scope of the Regulations. This means looking beyond what is stated on the commercial licence to the activities actually undertaken by the Licensee during a financial period. For example, and company with General Trading listed on the commercial license may engage in ESR Shipping Business Relevant Activities if products are being shipped between jurisdictions.

Notifications

A maximum period of 6 months is granted from the end of the fiscal year.

Economic Substance Reports

A maximum period of 12 months is granted from the end of the fiscal year.

Failure to submit a Notification: AED 20k

Failure to submit an Economic Substance Report:

Failure to provide accurate or complete information:

Yes, Businesses that carry out a Relevant Activity during a financial period are required to submit a Notification irrespective of whether they earned income from that Relevant Activity.

Only Licensees that earn income from a Relevant Activity during the relevant financial period and that are not exempt from the Regulations are required to demonstrate economic substance in the UAE and file an Economic Substance Report. Economic Substance Reports must be filed within 12 months from the end of the relevant financial period.

Yes, if the Licensee is an Exempted Licensee or does not earn income from its Relevant Activity. In these cases, there is no requirement to file an Economic Substance Report. The Economic Substance Filing Portal will automatically assess whether you need to file an Economic Substance Report based on your Notification, and only create a Report if you are required to submit one.

Yes, a Licensee will be required to submit a Notification and Economic Substance Report (if applicable) for each financial period in which it undertook a Relevant Activity.

You can email us at: moeesr@economy.ae

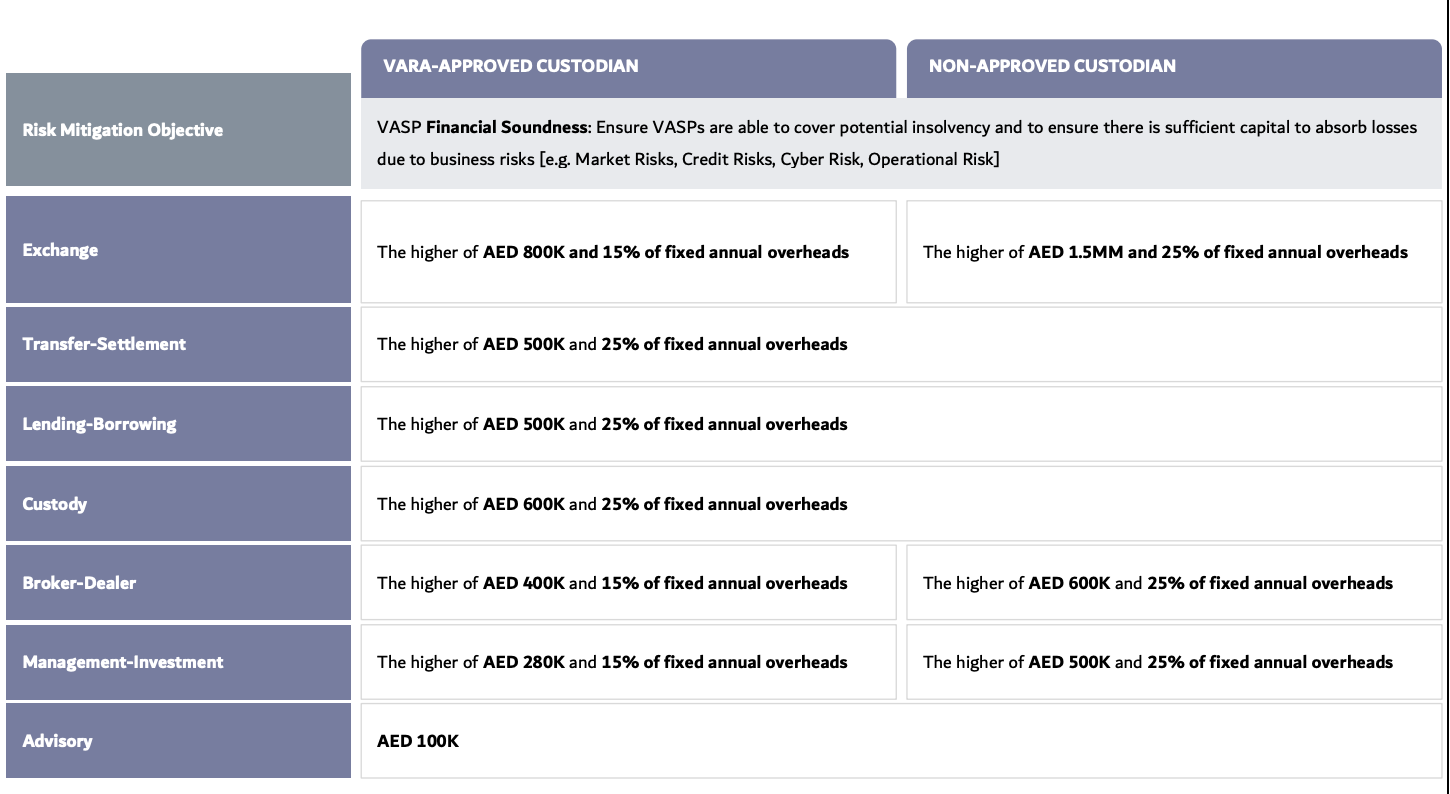

The VARA Virtual Assets and Related Activities Regulations 2023 is a bespoke Virtual Assets regulatory regime, which aims to provide VASPs with clear, comprehensive rules for offering Virtual Asset services and activities to the market.

The VARA Virtual Assets and Related Activities Regulations 2023 with the accompanying Rulebooks has been published on www.vara.ae under the ‘Regulations’ section.

Please see Public Register on www.vara.ae under ‘VARA Licensing’ Section.

VARA aims to foster consumer protection with a regulatory framework.

1. Various License categories are available based on the activity that the VASP intends to offer the market, noting that each activity is ‘discrete’ and hence must be applied for explicitly, based on the requirements for each as stipulated by VARA:

2. Additionally, issuers of Virtual Assets will have to obtain approval from VARA under the VA Issuance Rulebook.

3. Key Notes:

No VA activity is ‘exempt’ from regulatory supervision; as such any VA service or activity requires a VARA licence, registration or No Objection Certificate [NOC].

You may apply for a VARA licence through Department of Economy and Tourism [Mainland], or any Free Zone except DIFC.

There is a two-stage approval process.

Stage 1 – Initial Approval – VASPs are required to fill an Initial Disclosure Questionnaire [IDQ] with DET or a FZA, which will be screened by the commercial licensing bodies, then transferred to VARA for assessment.

Stage 2 – Upon completion of such requirements, the VASP can then apply for the full licence approval [which may include certain conditions and restrictions such as access to retail customers].

VASPs may be rejected if they are unable to fulfil VARA licensing requirements

Please refer to Virtual Assets and Related Activities Regulations 2023 page 36, published on www.vara.ae

VASPs can provide services to retail customers upon approval of an FMP Licence and following payment of the associated licensing fees. Certain VASPs may be approved to only provide services to qualified investors and institutional clients, at VARA’s discretion.

VARA is accepting all nationalities who comply with regulations to provide VA services in Dubai. Any entity wishing to undertake/provide regulated virtual asset activities and services across the Emirate of Dubai must apply to VARA licence.

Finalisation of the licensing application process is dependent on the completeness and accuracy of the required documentation and evidence submitted to VARA.

A Limited Liability Company [LLC] or FZ CO is preferable for this sector. Sole proprietorship is not allowed.

A comprehensive checklist of document requirements for successful submission of an FMP License Application is available for your reference, this checklist captures and defines requirements for documents such as, but not limited to:

VARA requires physical presence to conduct VA activities from Dubai.

The below regulated VA activities require a private office to conduct business:

There is no size/ spacing requirement from VARA. Please check with your commercial licensor [DET/ FZ] on spacing requirements as per your staffing needs.

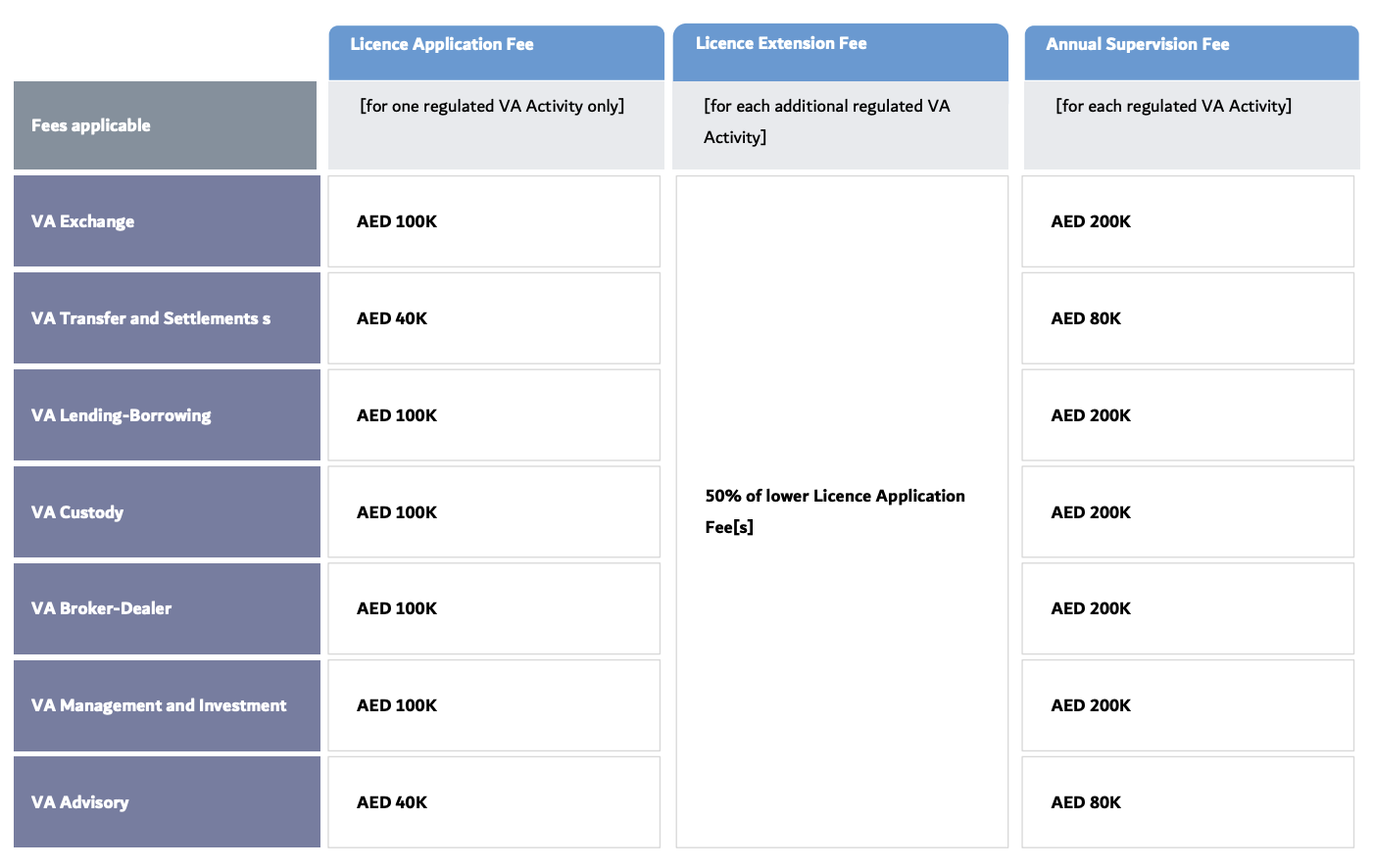

Licence Application Fees are due following issuance of initial pre-operational licensing letter by VARA, while Licence Extension and Annual Supervision Fees will be due yearly.

VASP’s are required to pay 50% upfront non-refundable VA licencing fees at the stage of initial approval from VARA. the fees is required to be paid directly to VARA online or through bank transfer.

The remaining licening fees + Annual Supervision Fees is required to be paid directly to VARA through bank transfer or online VARA portal [at the final approval stage].

Below are the details of the bank account.:

Beneficiary A/C Name: VIRTUAL ASSETS REGULATORY AUTHORITY.

IBAN: AE380260001015818053501

Bank: Emirates NBD, Dubai, U.A.E.

Swift: EBILAEAD

VASP’s are required to pay 50% upfront non-refundable VA licencing fees prior to submitting your full application [after receiving the Application Acknowledgment Fees [AAN]].

Fees are required to be paid directly to VARA either through bank transfer or online VARA portal.

The remaining licening fees + Annual Supervision Fees is required to be paid directly to VARA through bank transfer or online VARA portal.

Below are the details of the bank account.

Beneficiary A/C Name: VIRTUAL ASSETS REGULATORY AUTHORITY.

IBAN: AE380260001015818053501

Bank: Emirates NBD, Dubai, U.A.E.

Swift: EBILAEAD

VASPs will have until 30 June 2023 to complete the FMP licensing application process. VASPs who do not meet this deadline will not be able to commence or continue Virtual Asset Activities in the Emirate. At this stage, VASPs intending to pursue VA services will be required to recommence their application for a market license and can connect with VARA for their situation-specific considerations

1. Enforcement actions will include Warnings, Fines and Penalties [e.g. licence suspensions, or scope of service or market limitations]. 2. VARA will supervise the virtual asset market in the Emirate via on-chain and off-chain methods to ensure compliance with our Regulations and Rulebooks. Failure to comply may result in substantial punitive measures which could include material fines and penalties [including potential entity closure]. 3. All relevant actions are coordinated with relevant government and commercial licensing bodies. More information about VARA’s fines and enforcement can be found at this link: [Download Guidelines]

Entities will be required to hold a VARA Licence or Acknowledgment of Application Notice [AAN] if they carry out any of the following VA activities, namely:

Entities that issue Virtual Assets must seek approval from VARA regarding the issuance of the Virtual Asset. Such entities should also determine if any of their activities relating to the Virtual Assets fall within the categories of VA Activities described above. Note: VA Proprietary Trading is an activity that requires a No Objection Letter [NoC] from VARA.

VA Proprietary Trading above certain trading volumes is an activity that must be registered with VARA to confirm that the activity may be undertaken without a VA Licence. Technology services utilising Distributed Ledger Technology [DLT] will have to determine if they are carrying out any Virtual Asset activity falling within the categories described above, and they may either be licensed or require registration with VARA.

Distributed Ledger Technology [DLT] Service Providers may be required to hold a VARA Licence at this time if they are providing or carrying out any of the below mentioned VA activities:

You may apply for an activity amendment through Department of Economy and Tourism [Mainland], or any Free Zone except DIFC. There is a two-stage process.

The Deadline to receive the IDQ is 30.April.2023.

Failure to comply with the regulatory framework may result in substantial punitive measures – material fines/penalties including potential firm closure.

VASPs who received [AAN], must complete the full VA licence application and ensure submission by 31.August.2023.

Renewal of Commercial licence for existing legacy who received an AAN [no change in the VA activity applied for], doesn’t need VARA’s approval. However, VARA needs to be notified by DET/ Free zone.

Amendment of licence [change of name/ UBO/ address] of existing legacy [Require VARA Review/ Notification], requires VARA’s approval, as VARA’s will issue an amended AAN to the VASP.

Change of a VA Activity [for legacy] or [Add/ remove] requires VARA Review. A New IDQ is required to be submitted.

Withdraw of Commercial licence [Legacy] requires DET/ Free Zone to notify VARA.

VARA will withdraw the AAN for any establishment that cannot fulfil FMP requirements.

VARA can withdraw the AAN for the below scenarios:

All event organisers are required to apply for events in Dubai through the e-Permit system of the Department of Economy and Tourism.

You may apply for a VA event through the e-Permit system, by selecting the category [VA event].

VARA reminds all concerned parties to confirm their adherence to the VA guidelines on the e-Permit system of the Dubai Government. 4. Failure to comply with VARA’s marketing regulations may result in substantial punitive measures including material fines/penalties and potential entity closure

means offering, providing or agreeing to provide a personal recommendation to a client, either upon its request, or on the initiative of the Entity providing the recommendation, in respect of one or more actions or transactions relating to any Virtual Assets.

means any of the following –

*As per Regulation II – Issuing Virtual Assets, any Entity in the Emirate that Issues a Virtual Asset in the course of a business, must comply with the VA Issuance Rulebook [latest version that is aligned with the issuance date]

means safekeeping Virtual Assets for, or on behalf of, another Entity and acting only on verified instructions from/on behalf of such Entity*. *All VASPs shall be subject to Rules regarding the storage and custody of clients’ Virtual Assets. Only VASPs which segregate each client’s assets in separate VA Wallets will qualify for a Custody Services Licence.

means any of the following –

means carrying out a contract under which a Virtual Asset shall be transferred or lent from one or more parties [the Lender(s)] to one or more other party [the Borrower(s)] where the Borrower(s) shall commit to return the same, at the request of the Lender(s), at any time either during or at the end of the period agreed upon, either to its interest or on behalf of others interest.

means acting on behalf of an Entity as an agent, or fiduciary, or otherwise taking responsibility for the management, administration or disposition of that Entity’s Virtual Assets. Examples may include, but shall not be limited to –

means offering, providing or agreeing to provide a personal recommendation to a client, either upon its request, or on the initiative of the Entity providing the recommendation, in respect of one or more actions or transactions relating to any Virtual Assets.

Any Entity in the Emirate that actively invests its own portfolio in Virtual Assets.

In case of final approval rejection [rejection reasons will be mentioned in the rejection letter], VARA will cancel its initial approval. If the company wishes to re-apply for another VA licence, they will need to go through the process again. In case the company, doenst want to apply for another VA licnece, then the company would need to shut down.

This is up to the free zone itself.

In case of final approval rejection [rejection reasons will be mentioned in the rejection letter], VARA will cancel its initial approval. If the company wishes to re-apply for another VA licence, they will need to go through the process again. In case the company, doesn’t want to apply for another VA licence, then the company would need to shut down.

VARA’s initial approval allows to issue a VA non-operational commercial licence [the licence will have a water mark for attention and a comment saying that its [VA nonoperational and requires to fulfill VARA’s requirements for the final approval].