Fundraising – it’s a crucial aspect of any start-up business. Garnering enough funds to get started can prove challenging — and your business’s future success depends on it. But, if you do your research and build the right relationships, capital is out there for the taking. From angel investors to venture funds, there’s money available for your business, if you know where to look.

In this guide, we’ll be covering the benefits of raising venture capital in Dubai, the documents you’ll need to raise venture capital, steps you’ll need to take to raise venture capital, and how to find angel investors in Dubai.

First of all, it’s important to note that fundraising is both a science and an art. The way in which a start-up is able to raise money will also vary in each case. Some may use personal savings or money borrowed from family to get started; others have found crowdfunding to be a useful way to get enough money together in the first instance. However, venture capital funding remains the main source of initial income for start-ups — and it’s currently at an all-time high.

Corporate venture capital (CVC) is the investment of corporate funds directly in external startup companies. CVCs tend to invest with a strategic goal in mind: that might be to tap into innovation in industries related to their own, as well as gaining a financial return on their investment. The CVC model can prove to be very beneficial for both the investor and the start-up; this is because the start-up not only gets funding, but also the insight and infrastructure that comes with partnering with a much larger or more established corporation. Meanwhile, the investors are able to boost their innovation and gain an extra income stream.

Corporations often find that the best way to test-drive a start-up before investing is to provide them with a proof of concept (POC) around a collaboration concept that takes a couple of months to complete. Once the POC is successfully completed, the corporation can feel confident in onboarding this start-up — and can start to explore ways in which to invest in them for the most profitable outcome.

Another upside to this CVC approach is that it allows start-up companies to build a track record of performing well and offering a strong return on investment. This, in turn, helps them to attract additional investors which then allows them to grow their business further.

What Is Crowdfunding for Business?

A company can raise funds through crowdfunding by securing small, individual contributions from a large pool of donors through online platforms such as Kickstarter, GoFundMe and other social networks. By expanding investor pools beyond traditional owners, relatives, and venture capitalists, crowdfunding websites are bringing investors and entrepreneurs together for the purpose of increasing entrepreneurship.

There are three main crowdfunding models:

1. Equity crowdfunding – An investor receives a share of a company’s equity or a portion of a specific product’s revenues or profits in exchange for their investment. Usually, this model is best suited to growing companies at an early stage.

2. Debt crowdfunding – A company borrows money from investors at relatively high interest rates. Due to their small loan sizes, they mitigate their overall lending risk by spreading large sums of money over many loans.

3. Donation/rewards-based crowdfunding – Companies set a fundraiser goal and solicit donations for the development of an eventual product or service in exchange for some token or receipt. Investors receive their funds back if the target is not reached.

Documents Required to Raise Venture Capital in Dubai, UAE

So, what paperwork will you need to get started as a business looking to raise venture capital? There’s a de facto industry standard, in terms of what venture capitalists expect to be provided with at each stage of the application process — which is useful to know, as it gives start-ups the opportunity to prepare everything they need with confidence, ahead of time.

In essence, these documents need to show that the start-up in question has the potential to grow into a large, thriving and profitable company in a suitably short period of time. This is what will ultimately tempt venture capitalists to invest.

Some of the key documents you’ll need to produce at this early stage are:

- An introductory summary of what your start-up does, and why: write a couple of sentences that include your key differentiator or hook — like an elevator pitch in writing.

- What problem does your start-up solve? State facts and reference points, showing how you’re solving this problem and why your solution is unique.

- Your business model: This may be as simple as a couple of sentences, which you can then expand upon in your business plan to include sales and marketing strategy.

- Who’s in your management team, and what are their skills/experience? Short bios of all the key members of your team are useful to include.

- Top-line financial projections, as well as your bottom line to show revenues, expenses and profits on one clear page. In your business plan, you can expand on this to show the full financial model.

Ways to Raise Venture Capital

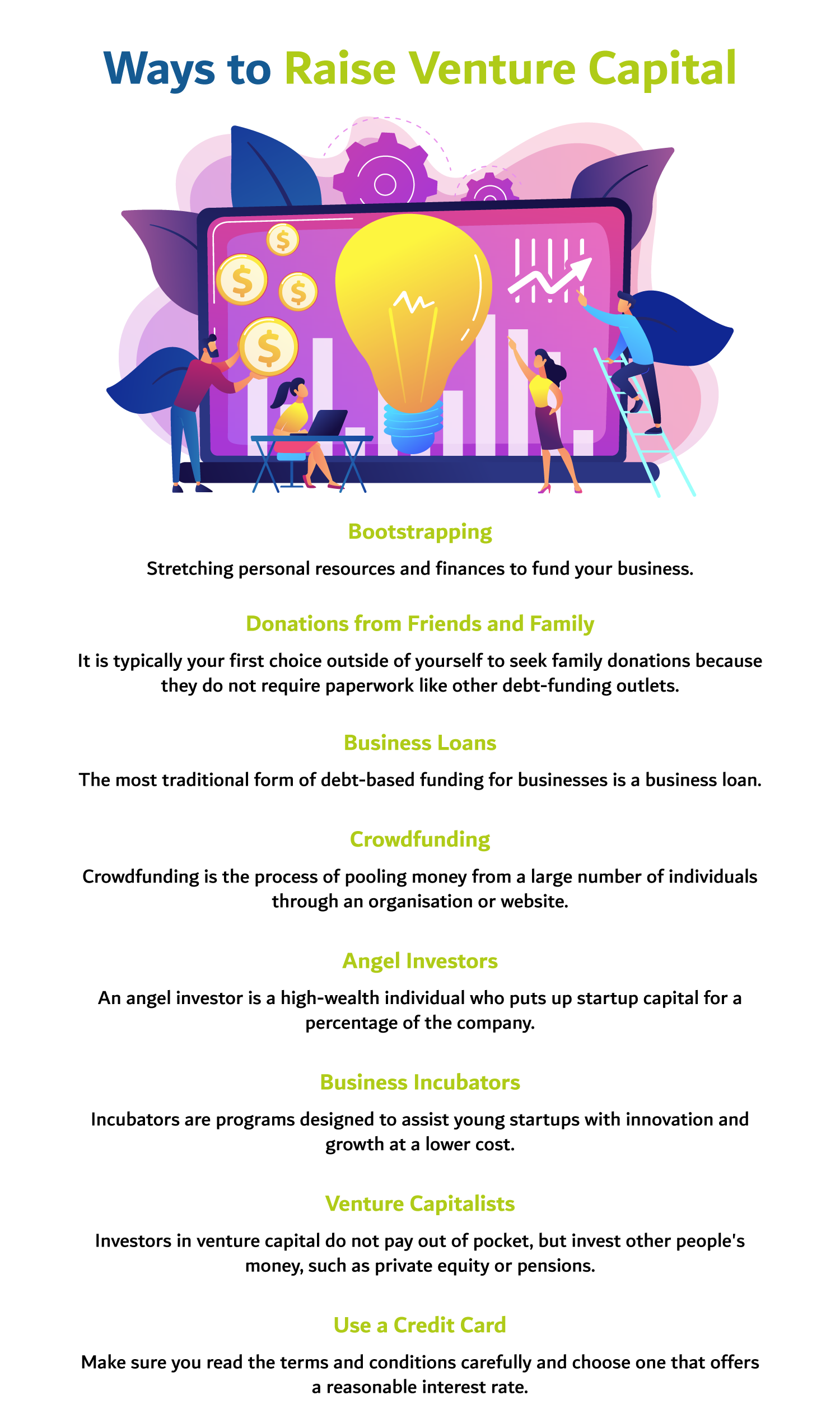

Financing your startup can be done in a variety of ways. Do your research, think about what will work for you, and make sure to ask questions along the way. Here are a few ways to raise venture capital:

- Bootstrapping – Bootstrapping means stretching your resources and finances to fund your business. In other words, you are starting your business with your own money and assets. There are many advantages to this option, including full control, being forced to strive for efficiency, and no debt or obligation to third parties.

- Donations from Friends and Family – It is typically your first choice outside of yourself to seek family donations because they do not require paperwork like other debt-funding outlets. The equity or control in your company can be preserved by crowdfunding your inner circle for capital in the form of debt.

- Business Loans – The most traditional form of debt-based funding for businesses is a business loan. Investors and venture capital firms take losses, but banks do not. Low interest rates are offered by government-backed loans, but they have strict requirements. Start-ups without track records may struggle to qualify for personal loans due to high interest rates and good credit requirements.

- Crowdfunding – Crowdfunding is the process of pooling money from a large number of individuals through an organisation or website. Donations, equity or tangible rewards may be exchanged for capital, such as merchandise, exclusives, and memorabilia. Taking the rewards-based approach also allows you to maintain a high level of control over your business.

- Business incubators – Business Incubators offer support and resources for early-stage businesses, which young firms find difficult to access. This support may include networking opportunities, investments, mentorship, or co-working spaces alongside other companies and experienced professionals.

- Angel Investors – An angel investor is a high-wealth individual who puts up startup capital for a percentage of the company. In addition to investing, angels often serve as mentors or advisors in a company, so their industry knowledge is essential. On the other hand, angel groups pool the money of several angel investors to invest a significant amount in various startups at once.

- Venture Capitalists – The venture capitalist exchanges startup capital for equity, similar to an angel investor. Investors in venture capital do not pay out of pocket, but invest other people’s money, such as private equity or pensions. Therefore, they generally invest in high-risk, high-reward companies, such as young technology startups, so they can be sold or go public.

- Use a Credit Card – Consider using a business credit card to finance part of your startup costs. Starting a business this way is a popular choice for many business owners. Make sure you read the terms and conditions carefully and choose one that offers a reasonable interest rate. It’s important to make sure you can pay off the balance on a monthly basis.

Steps to Raise Venture Capital in Dubai, UAE

May have posed the question, “how do venture capital firms raise money?” The process is quite simple. Read on to be well versed in the steps to raise venture capital.

1: Introduction and application

Many venture capital organisations have an online submission process. If possible, however, try and find a contact at the organisation that you can approach directly — at an event or informal meeting, or through the reference of a trusted source. This may give you the edge over other applicants.

At this stage, these are some of the key documents to prepare:

– A short pitch deck: covering your management team, top-level financial forecast, and information on the product or service your startup provides.

– A short executive summary, plus a short business plan including two pages of financial information.

Plus: remember to include your contact information, in case the venture capital corporation is interested and wants to get in touch with you!

2: First meeting

You’ve been invited for a meeting — so make sure you come prepared for any questions your potential investors might have. At this stage, you’re likely to be delivering a pitch to them — and they’ll want to quiz you on your business to make sure you’re clear on financials, projections and more.

3: Due diligence process

If you reach this stage, congratulations! Get past this part of the process, and you’ll have an investor on board! But the deal’s not done yet, so make sure you don’t rest on your laurels. The due diligence process is often the final hurdle, where the venture capital organisation will require a number of final deep-dive insights into your business. These could include:

- A full business strategy, including marketing strategy and market analysis. This may be as lengthy as 20-30 pages.

- Feedback from your customer: prototype or customer validation surveys, to show how well your product or service is being received.

- Information on any loans or financial liabilities, so the investor can see if there’s anything that might hinder cash flow and revenue.

How to Find Angel Investors in Dubai

Angel investors — essentially, a one-person equivalent of a venture-capitalist corporation — are also a great option. These arrangements are often less formal, and involve the angel investor investing their personal finances in a start-up in return for an equity stake in the business. There are many networks out there — such as the Middle Eastern brand of Angel Investment Network — that specialise in connecting investors with start-ups. Tap into these excellent resources, make sure you come prepared to meetings at every stage, and good luck!

For more guidance on your next steps as a start-up, get in touch today.

To find out more, visit our website, or get in touch with us via setup@meydanfz.ae or 800FZ1.

If you prefer, you can visit us at Meydan Free Zone Business Centre, Mezzanine Floor, Meydan Hotel, Meydan Rd, Nad Al Sheba 1, Dubai, UAE.

FAQ 1: How can we raise capital in the UAE?

In order to raise funds for your business in the UAE, you can look locally for investors via business incubators, bank loans, family and friends, crowdfunding in Dubai as well as angel investors in UAE.

FAQ 2: Is crowdfunding legal in the UAE?

Crowdfunding is legal in the UAE. The Dubai government launched DubaiNext, a digital crowdfunding platform designed to help SMEs. As of March 2022, both public and private sectors have been permitted to participate in crowdfunding activities.

FAQ 3: Who is an Angel Investor?

Angel investors invest their own money in small businesses in exchange for a minority stake (usually 10% to 25%). The majority of angel investors are entrepreneurs or business people with extensive experience.

FAQ 4: What are the types of fundraising for a business?

There are a number of types of fundraising for business in the UAE. Some of them include pre-sales, bootstrapping, donations from friends and family, credit cards, strategic partners, business loans, crowdfunding, angel investors and venture capitalists.