The UAE is designed for business, and to that end everything has been done to encourage and support entrepreneurs as well as business people. This means creating a secure and well-regulated environment which continues to attract companies from around the world.

From time-to-time certain new regulations are brought in or changed, and so it’s important to ensure that you remain up-to-date and your business is fully compliant.

Who is the Ultimate Beneficial Owner (UBO)?

Let’s start at the beginning. UBO is a set of regulations put in place to increase financial transparency when it comes to business ownership – with the goal of more effectively combating money laundering and terrorist financing.

These new rules are not particularly difficult to meet, and working with an expert can help ensure that your company remains fully compliant with these regulations.

What is an Ultimate Beneficial Owner (UBO) in the UAE?

In short, the ultimate beneficial owner (UBO) is the person who is the ultimate beneficiary of a company. Let’s take a simple example: If a person owns significant shares in Company X, and Company X itself in turn owns significant shares in Company Y, then the person in question would be seen as the UBO of Company Y. (This is so unless the ownership is through an indirect arrangement.) In this way UBO regulations trace a line of ownership or influence from one company to another.

Of course in reality there may be many, complex layers of ownership when it comes to a company, so this is what needs to be unpicked carefully to ensure that the UBO is clearly identified.

Unless you are exempt, as a UAE business owner, you need to prepare a register of beneficial owners of your company, and file it with the authorities. Not doing so could result in a penalty, so it’s important to take action.

Scope Exclusion: The Regulations do not apply to the following entities

- Companies wholly owned by the Federal or local government or any other companies wholly owned by these companies

- Companies licensed or registered in Financial Free Zones of UAE (Dubai International Financial Centre and Abu Dhabi Global Markets).

Why is UBO important?

Ultimate Beneficial Ownership regulations in the UAE are extremely important as they are designed to boost transparency, and in so doing will help reduce the avoidance of tax, money laundering, as well as reduce other areas of criminal activity.

It has a secondary benefit as well – by further strengthening the regulatory environment, the UAE will continue to attract more global businesses to the country, aligning it more closely with best-practice environments.

It comes together to further cementing the UAE as a global destination for business.

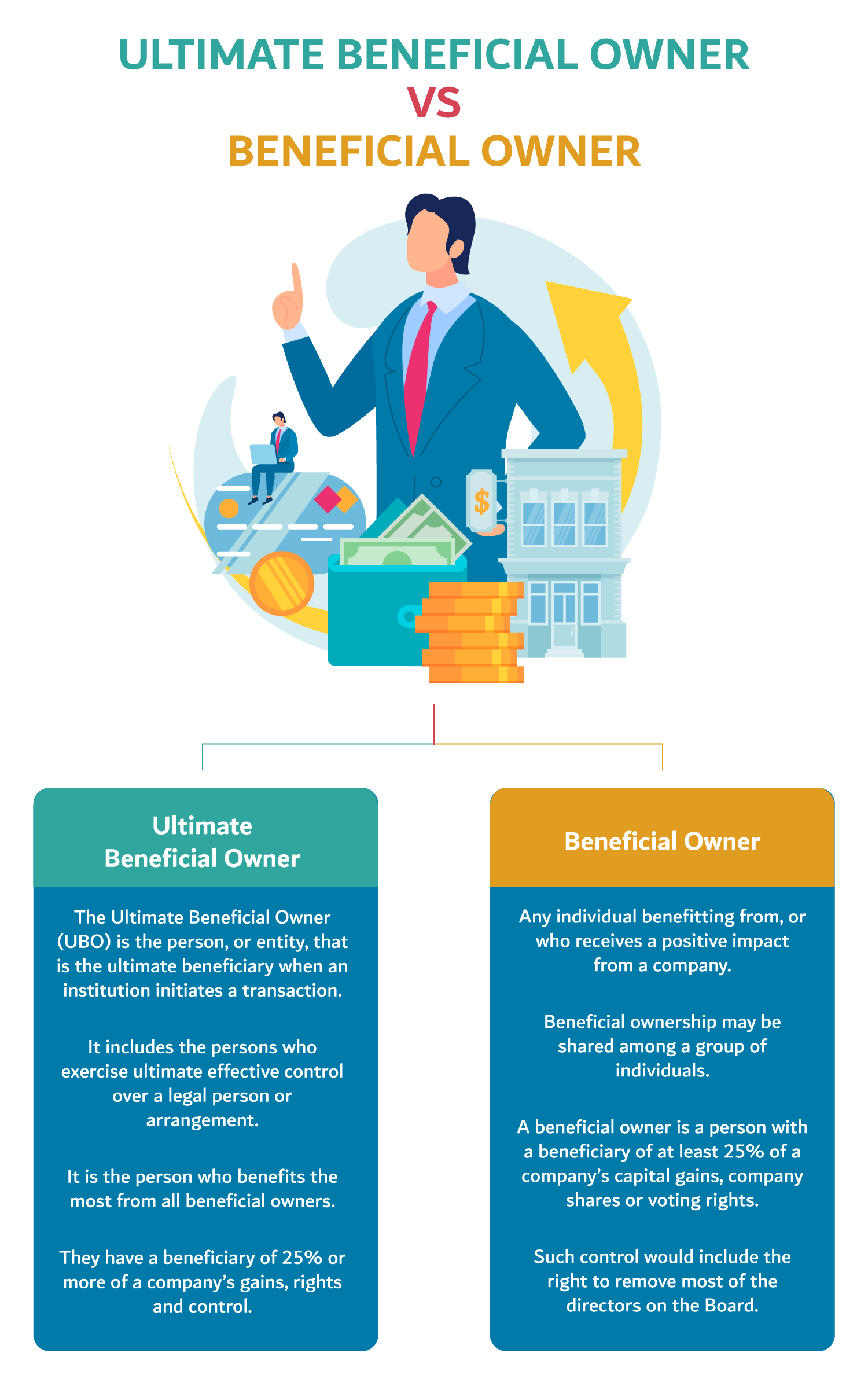

Ultimate Beneficial Owner Vs Beneficial Owner

An Ultimate Beneficial Owner (UBO) is someone who receives maximum benefit from a financial transaction, and even more in comparison to a Beneficial Owner (BO).

In simple terms, a UBO receives the most benefit and welfare regardless of the chain of control, whilst a beneficial owner is someone who enjoys the benefits of ownership even though the title to the relevant property is entitled to another name. UBOs sometimes conceal their identities and can be less visible than the general BOs, for instance, shareholders, guardians of minors, people with the power of attorney, or even nominee directors that indirectly or directly receive an abundance of benefits or profits. With beneficial ownership, a ‘natural’ owner is inclusive of the term, instead of a member or a shareholder, and establishes ownership or control in a legal entity or arrangement.

Breaking Down UBO Regulations

Apart from companies set up in financial free zones, or those owned by the government, UBO regulations apply to all UAE businesses. They were introduced in October 2020, giving businesses 60 days to create a process that would enable the filing of their UBO information. While it’s down to the individual business to decide on their UBO, there is guidance for them to follow.

When you’re looking at your own company, a UBO is defined as someone who has control, or voting rights, with at least a 25% shareholding in the company. This individual would also have the ability to fire most of the managers and directors in the company. In cases where there is no such person, then it’s down to whoever has the most significant control over the business.

You also need to decide who are the nominee directors and managers. This is a little easier, in that they’re usually in senior positions but, importantly, they are following instructions from someone else.

While partners and shareholders are currently classified in UAE commercial company law, the UBO regulations mean further information is required, including the voting rights of each shareholder.

It is not known whether the UBO information will remain private (i.e. just for official use) or will be made public.

It’s also important that your company notifies the authorities if any significant changes occur in your company which might affect the UBO. This must be done within 15 days of the change being made.

There is a penalty for not complying with the UBO, including fines or other penalties from the UAE Ministry of Economy.

Steps for UBO Tracking and Reporting of Compliance Through a Declaration

- Initial tracing and Identification of UBOs

All the registered entities are required to file a declaration with personal particulars ( e.g. name, nationality, address, passport, date of birth, extent of shareholding etc.) relating to identification and authentication of their shareholders/partners and or their ultimate beneficial owners with the Registrar and the licensing authorities ( e.g. Ministry of Economy, Meydan Free Zone) registered in the UAE. The expected date at the time of incorporation/ registration of new companies.

Note : The Registrar may also require the submission of their passport copy, proof of residential address, share certificates, MOA etc., and any other relevant documents in relation to the UBOs and possibly senior management and or nominee board members as well.

The affected entities are thus required to take adequate steps to compile and maintain relevant and up-to-date accurate data on their real beneficiaries and maintain the same in the future, including any subsequent changes.

- Prepare company secretarial records

All the companies are thus required to maintain the following registers:-

-

-

- A Shareholder and or Partner’s Register

- A Register of Beneficial Owners( e.g. even may include relevant details of local sponsors based on side / Trust / Mudaraba / Foundation agreements etc.

- A Register of Directors and Nominee Board members/Directors.

- Any changes to such information shall have to be updated within fifteen (15) days from the date of the change.

-

- Submission of a UBO declaration to the competent authorities

-

- There will possibly be severe consequences for non-compliance and the Minister of Economy or the Licensing Authority may impose sanction(s) from the list of administrative sanctions, that may be issued in due course.

- The method of submission of the UBO declaration are online. Connect with our staff on 800FZ1 to know how to file for UBO or log into our online portal to find all information.

FAQ 1: What makes a beneficial owner?

Primarily, a beneficial owner is someone who owns and exercises more than 25% of a company’s shares and voting rights (if applicable).

FAQ 2: What does UBO stand for?

UBO stands for Ultimate Beneficial Owner.

FAQ 3: What is the difference between beneficial owner and ultimate beneficial owner?

A beneficial owner is someone on whose behalf the financial transaction is conducted, simply, the ‘natural’ beneficiary. An ultimate beneficial owner is someone who receives the paramount benefit when an organisation or institution goes ahead with a transaction.

FAQ 4: Why do we need to identify UBO?

The most important reason is to prevent the occurrence of malevolent fraud like terrorist financing or money laundering by massive corporations and legal entities.

FAQ 5: How do you calculate ultimate beneficial ownership?

The company usually discloses the percentage of shares held by an UBO in its business verification check procedure.