Value Added Tax (or VAT) is an indirect tax, common across the world, charged on most supplies of goods (and services). VAT is charged throughout the supply chain, with businesses paying the government the VAT that it collects from customers – but equally may get a refund from the government on the tax it has paid its suppliers. In short, it adds value throughout the supply chain.

- What Is VAT?

- How Does VAT Work in the UAE?

- What is the VAT rate in the UAE?

- VAT vs sales tax: What’s the difference?

- How is VAT calculated in the UAE?

- VAT exempt sectors in the UAE

- VAT refunds

- VAT in real estate

- VAT-related responsibilities of businesses

- UAE government statement on VAT and who is required to register

- Government Entities and VAT purposes

What Is VAT?

VAT stands for Value Added Tax, and is essentially a consumption tax levied on goods and services and benefits the government as a form of revenue. As a general consumption tax, the VAT will apply to the vast majority of goods and services transactions. In contrast to income tax, VAT is the same for everyone and anyone consuming goods and services.

How Does VAT Work In the UAE?

In simple terms, VAT is applied at every stage of the value chain process, whilst the registered business selling the goods and services receives a tax credit on the paid VAT by the consumer of the good or service. On the other hand, the Federal Tax Authority (FTA) of Dubai also receives an income of 5% because of the VAT imposed. With Dubai’s reputation for having a consumer-oriented business environment, the introduction of a VAT allows the Dubai government to focus their resources on creating a good standard of living with happy citizens.

What is the VAT rate in the UAE?

VAT came into force in the UAE on 1st January 2018 and it stands at 5%.

VAT vs sales tax: What’s the difference?

While sales tax is imposed on the end consumer, VAT is imposed throughout the supply chain – which would also include the final sale. You will also find VAT on imports as a way of helping homegrown businesses remain competitive.

How is VAT calculated in the UAE?

You simply multiply the VAT rate (5%) by the cost price of the specific goods or services.

VAT exempt sectors in the UAE

Let’s now look at the categories where we see exemptions from VAT. These may include:

- Certain financial services

- Residential properties

- Local passenger transport

- Bare land

In addition, there are what’s called ‘zero-rated sectors’ where VAT is 0% on the main categories of supplies. This may include:

- Export where goods/services go outside the GCC region

- Supplies for certain forms of transportation as well as international transport

- New constructed residential properties under certain conditions

- Some investment grade precious metals

- Some education services and the relevant goods/services

- Some healthcare services and the relevant goods/services

- Certain transactions in goods between companies established in UAE Designated (Free) Zones (DZs) may not be subject to VAT. The supply of services within DZs is, however, subject to VAT in accordance with the general application of the UAE VAT legislation.

VAT refunds

You may receive a refund from the government on the tax you have paid your suppliers.

To request a refund, follow these steps:

- Go to the FTA’s e-Services portal

- Choose ‘VAT’, then ‘VAT refunds’, then ‘VAT refund request’

- Fill out the request form

VAT in real estate

Real estate and VAT comes down to whether the property is residential or commercial. Commercial properties do fall under the VAT requirement. In contrast, usually residential properties are VAT exempt. This in turn means that buyers don’t incur an irrecoverable cost. To assist real estate developers in recovering VAT on the construction of residential properties, the first supply of residential properties within three years of completion (at the time of VAT introduction) is zero-rated.

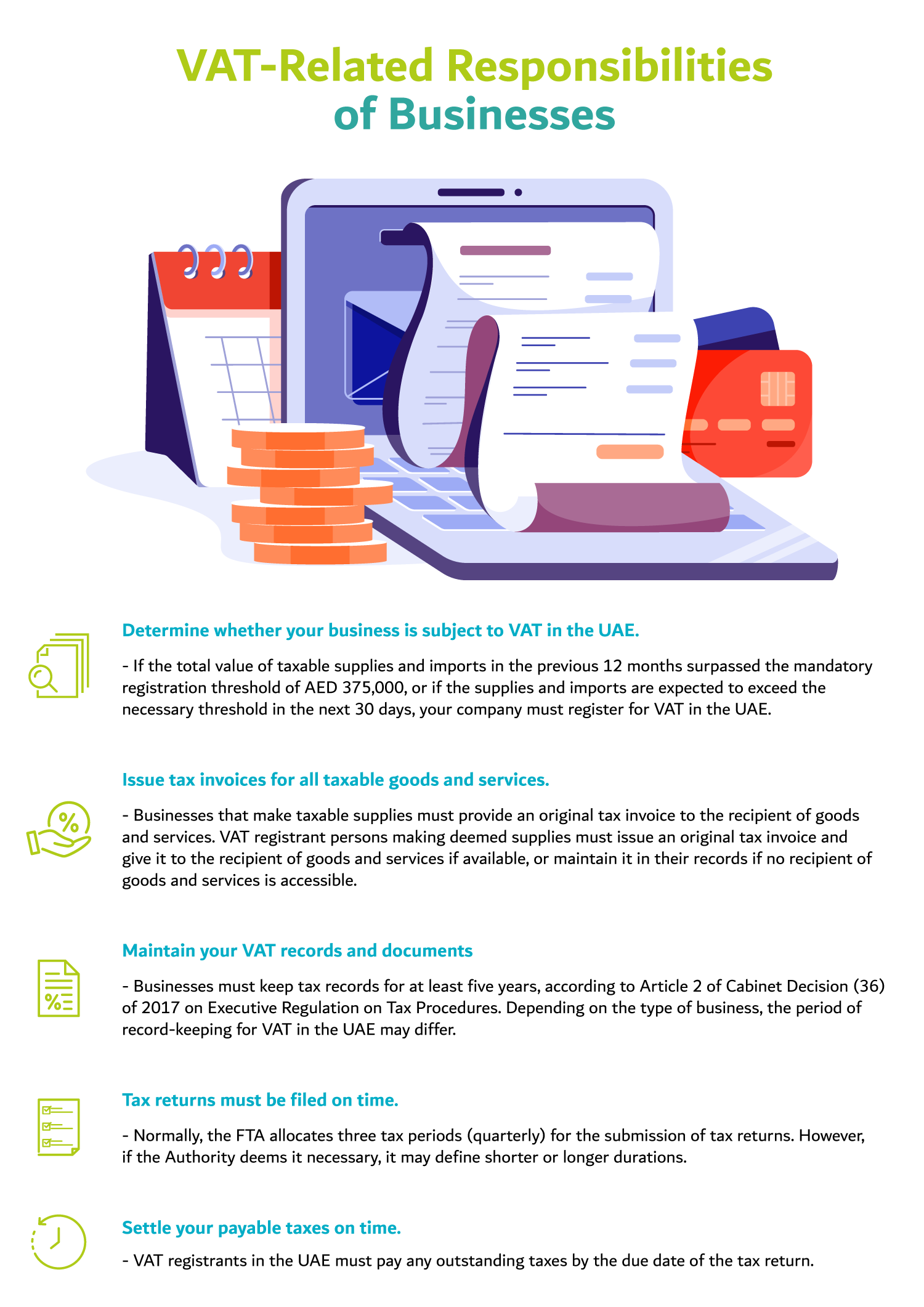

VAT-related responsibilities of businesses

Essentially as a business owner in the UAE you must note all your financial transactions to ensure your records are up to date. If you do meet the minimum annual turnover requirement, you will need to register for VAT. Even if you don’t meet the criteria, it’s good practice to keep your financial records in case the government needs to establish the fact that you do/do not need to be registered.

VAT grouping is allowed, provided certain conditions are met.

There are specific documentary and record-keeping requirements, such as the requirement to issue tax invoices and submit VAT returns (on a quarterly or monthly basis depending on the allocation by the Federal Tax Authority [FTA]).

UAE government statement on VAT and who is required to register

The government issued the following statement on the introduction of VAT in the UAE:

“Value Added Tax (VAT) was introduced in the UAE on 1 January 2018. The rate of VAT is 5 per cent. VAT will provide the UAE with a new source of income which will be continued to be utilised to provide high-quality public services. It will also help government move towards its vision of reducing dependence on oil and other hydrocarbons as a source of revenue.”

They also noted exact figures to help determine which businesses are required to register for VAT:

“A business must register for VAT if its taxable supplies and imports exceed AED 375,000 per annum. It is optional for businesses whose supplies and imports exceed AED 187,500 per annum.”

Excess input VAT can, in principle, be claimed back from the FTA, subject to a specific procedure. Alternatively, VAT credits may be carried forward and deducted from future output VAT.

Businesses that do not comply with their VAT obligations can be subject to fines and penalties. There are both fixed and tax-geared penalties.

Government Entities and VAT purposes

Supplies made by government entities are typically subject to VAT. This ensures that government entities are not unfairly advantaged as compared to private businesses.

Certain supplies made by government entities will, however, be excluded from the scope of VAT if they are not in competition with the private sector or where the entity is the sole provider of such supplies. Certain government entities are entitled to VAT refunds – this is designed to avoid budgeting issues and provide a level playing field between outsourced and insourced activities.

For the supplies provided for government entities, the treatment of such supplies depends on the same supply and not on the recipient of the supply. Therefore, if the supply is subject to the standard tax rate, the treatment will remain the same even if it is provided to a government entity.

FAQ 1: What is VAT in the UAE?

The UAE charges VAT on tax registered businesses on taxable supplies of goods or services at each stage of the supply chain. This general rate amounts to 5%, whilst some goods and services incur a 0% VAT rate.

FAQ 2: How do you calculate VAT in the UAE?

Based on the invoice you receive for the purchase of either a good or service, multiply the cost price by 5% in order to calculate the VAT amount.

FAQ 3: How to register for VAT in the UAE?

You can visit the website provided by the FTA and log in through the online registration portal in order to commence the simple process of registering which will be followed up by simple instructions.

FAQ 4: How to claim VAT refund in UAE?

To access FTA e-Services Portal, you will need your username and password. Refund forms are available under the VAT tab, then under VAT311 – VAT Refunds.Access the form by clicking on ‘VAT311 – New Tax Refund’ under the ‘Request VAT Refund’ box.

FAQ 5: How to file a VAT return in UAE?

The FTA portal can be accessed at eservices.tax.gov.ae. Make sure you meet all tax return requirements before filing the VAT return form.