Taxation is an unavoidable reality for any business, and if you are an entrepreneur planning to set up your business in the UAE, it is critical to understand the fundamentals of corporate taxation so that you can ensure compliance and minimize your tax burden.

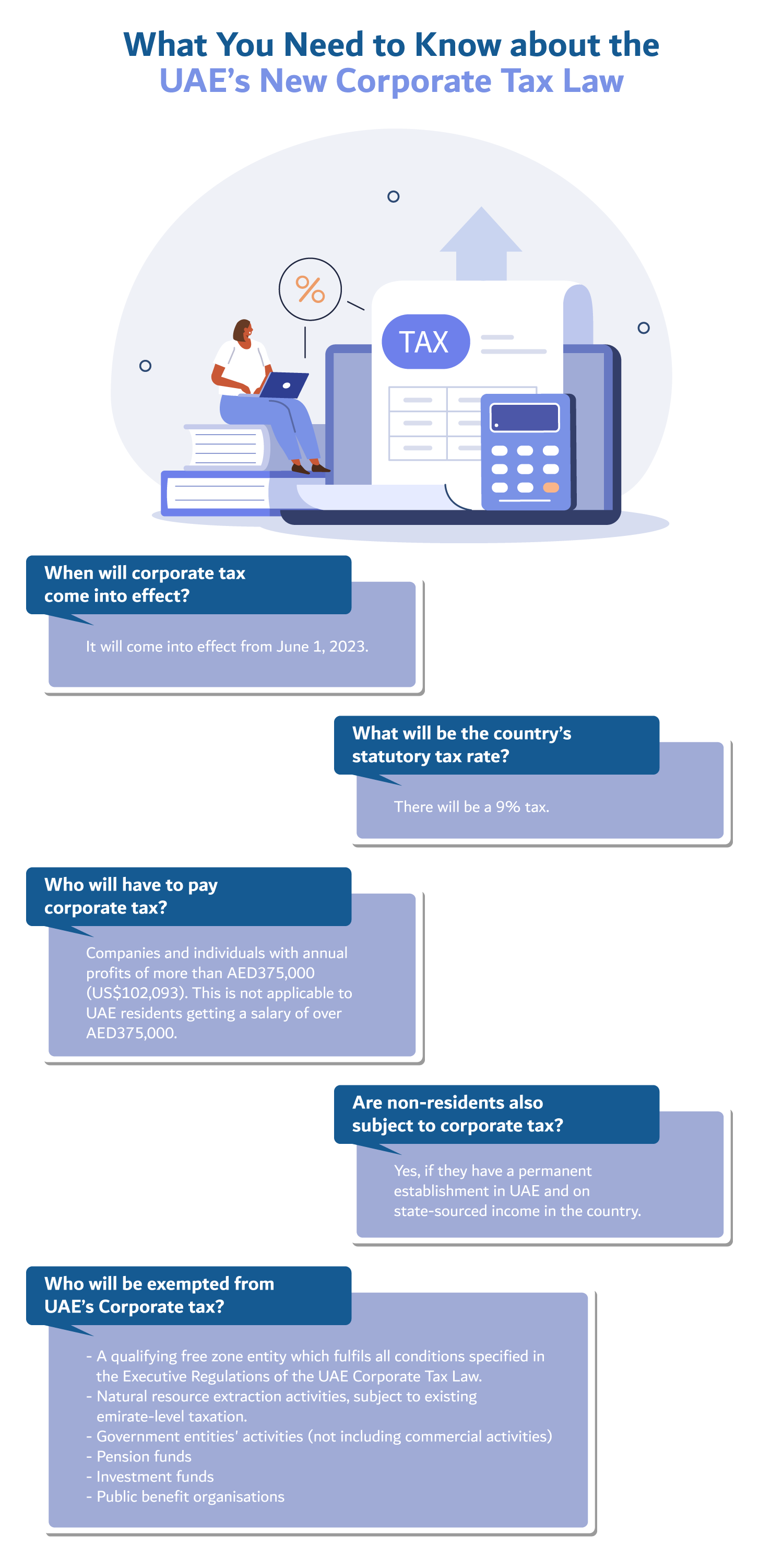

First announced at the beginning of 2022 by state news agency WAM, the UAE will implement a 9% corporate tax beginning June 1, 2023, with a profit threshold of AED 375,000 for businesses. This threshold was set in accordance with the government’s efforts to assist small and medium-sized businesses and startups.

In this article you will learn about the federal corporate tax. We will be covering:

Read on to learn the crucial details about corporate tax that UAE residents and businesses must know.

What Is the Federal Corporate Tax?

On December 9, 2022, the UAE issued a federal decree on corporate and business taxation to lay the groundwork for a 9% rate on taxable profits of more than AED 375,000 ($102,000). The legislation will take effect on June 1, 2023.

The UAE’s corporate tax, which is one of the lowest in the world, will be levied on the company’s profit rather than its total turnover. Levied in almost every country, it is worth noting that many of them have levied it at a rate that is more than double that of the UAE.

Profits under AED 375,000 will be taxed at zero percent to assist small businesses and start-ups, which means smaller businesses may still be able to claim money back from the tax administration as a result.

What Do UAE Residents Have to Know about the Corporate Tax?

UAE residents earning more than AED 375,000 will not be required to pay tax because it is not applicable to their salary. As for business owners earning managerial remuneration from the entity, a payment or benefit made to a connected person is deductible from revenue as an expense if made at arms’ length (Market standard level), and any excess payment or benefit is subject to corporate tax. The connected person includes the taxable person’s owners and directors.

Corporate tax will not be levied on personal income derived from bank deposits, savings and investment programs, dividends, or foreign exchange gains. Real estate income may be subject to corporate tax basis if it is derived from economic activity (leasing, selling, transferring, etc.), as conditions are stipulated in the executive decision in this regard. However, income from real estate investments in which the investment manager performs commercial activities may qualify as exempt income.

If you are a freelancer with a freelance permit, working under self-sponsorship and earning more than the threshold, you will be subject to corporate tax.

*Meydan Free Zone does not offer freelance license or freelance visa options.

What Do Non-residents Have to Know about Corporate Tax?

Non-residents are also subject to corporate tax if they have a permanent establishment in the UAE, as well as state-sourced income (from the sale of goods, provision of services, and so on) in the country. Non-residents’ earnings from operating aircraft and ships in international space are exempt from corporate tax. A non-resident is also exempt from corporate tax on income earned through an investment manager on real estate or other investments.

What Do Businesses Set up in a UAE Free Zone Need to Know?

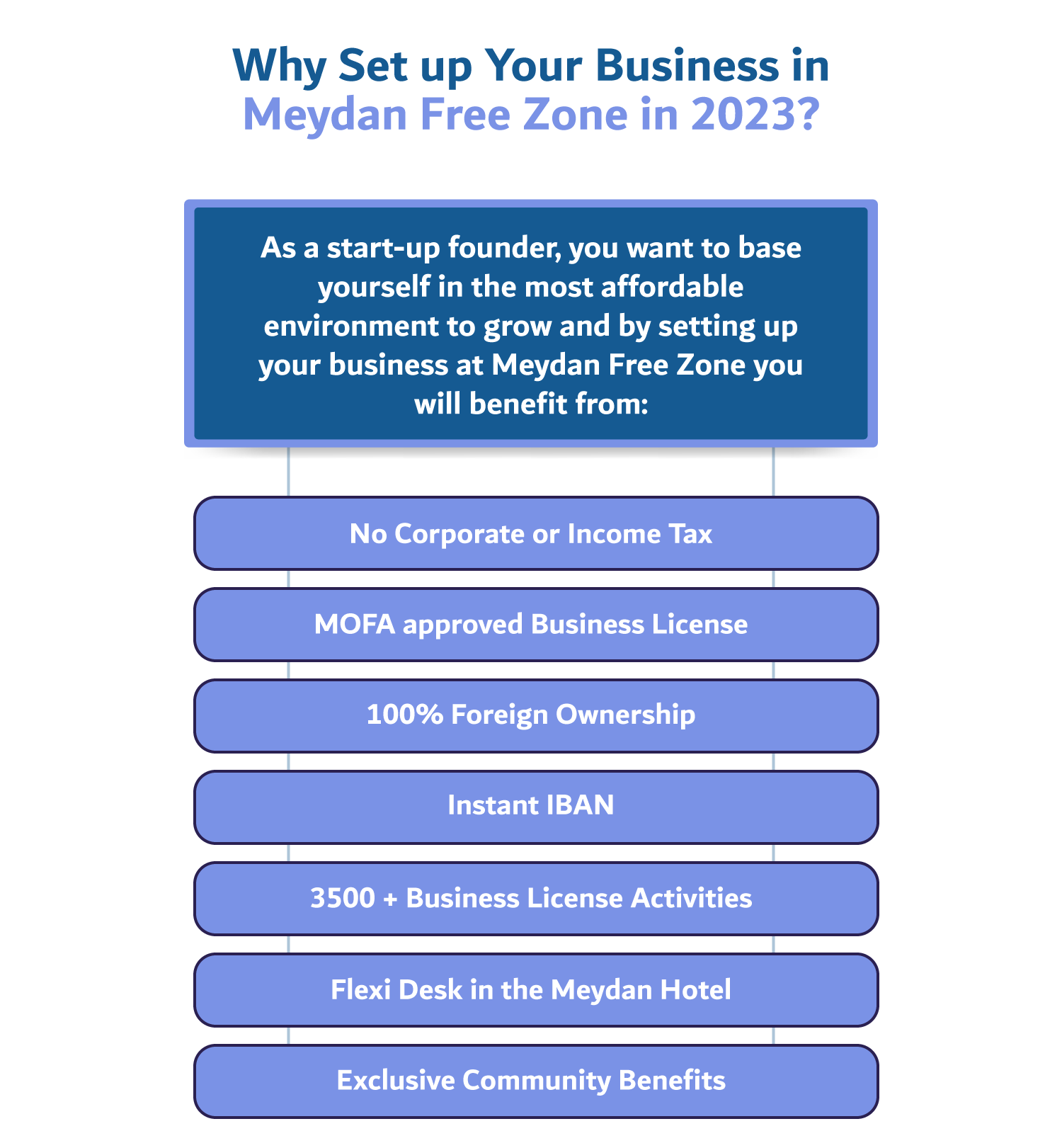

The UAE’s free zone companies have been a significant driver of the country’s international trade. Exemptions available to free zones include 100% foreign ownership, 100% customs and VAT exemptions, 100% repatriation of capital and profits, corporate tax exemptions, and so on.

The new corporate taxation allows the UAE Government to meet its agenda of economic reforms with growth because tax exemptions to such free zones act as a multiplier if certain conditions are met.

A qualifying free zone entity that meets all of the requirements outlined in the Executive Regulations of the UAE Corporate Tax Law will be exempt. Entities in a free zone would be eligible for tax exemptions if they:

- (a) maintained adequate substance in the UAE

- (b) derived “qualifying income”

- (c) complied with transfer pricing rules and maintained the relevant documentation, and

- (d) did not opt to be subject to Corporate Tax.

If a free zone entity earns non-exempt income (i.e. non-qualifying income), the entire income, including the ‘qualifying income,’ is taxed at 9%. However, the federal decree law seems to suggest that zero percent will be applicable on “qualifying income” and 9 per cent will be applicable on “non-qualifying income”. Subject to cabinet approval, such category-based taxation would provide significant relief and allow free zone entities to continue domestic operations.

Set Up Your Business With Meydan Free Zone Today

Why Meydan Free Zone?

Once you’ve been bitten by the entrepreneurship bug, pursuing the venture you are passionate about will become your top priority. Setting up a business involves making important financial decisions, completing a series of legal steps, and planning ahead, and Dubai’s Meydan Free Zone is an obvious choice given its significance as a business hub.

With technology-infused services and digitalized registration processes, Meydan Free Zone is a more than qualified hub to establish your business in, ensuring your start-up has a competitive advantage. Meydan Free Zone, located in the heart of Dubai, is surrounded by towering skyscrapers and excellent transportation systems, and its launch is sure to boost your business. Throughout the registration process, our team of experts is ready to respond to and listen to every question and request in order to ensure that the registration process is error-free.